Steel industry looks back a year: Difficult, even more difficult!

The decline in business of big names like Hoa Sen (HSG), Nam Kim (NKG), even Hoa Phat (HPG) is a sign of a sharp decline in Vietnam’s steel industry.

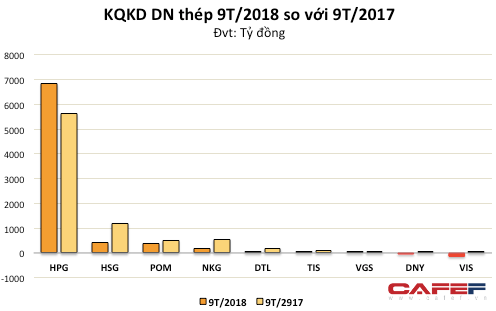

The statistics also showed that by the end of the third quarter of 2018, 11 steel enterprises listed on both HNX and HSX recorded total revenue of 135,552 billion dong, up 23% but profit declined by 6% to 8,277 billion dong. .

It can be seen that, after a few years of growth and increasing capacity increase to take advantage of the advantages gained, up to now, the “enthusiasm” of the business is having the opposite reaction, the market is constantly appearing. unfavorable factor makes the profit of steel industry significantly decline despite sales growth.

The premise for a breakthrough in the period 2016-2017

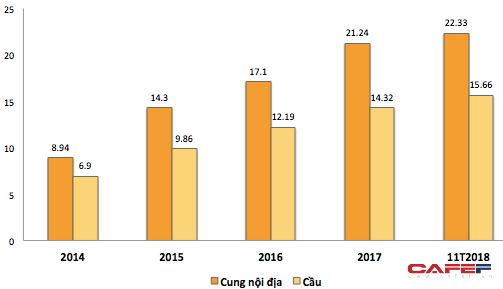

In-depth analysis, we first look at the “bright” period of the steel industry, the supporting forces for the period before 2018. Statistics by FiinPro, the CAGR double growth rate of the steel industry during 2014-2017 reached 20% level.

Steel output (Unit: Million tons)

Source: FiinPro

The above results are obtained by the whole double benefit industry, including:

(1) the recovery of real estate market since 2011, especially booming in the period 2015-2017 led to the growth of construction materials group. In parallel, the expansionary fiscal policy with a focus on domestic infrastructure investment is also a highlight for the steel industry. The question is, real estate has been warming since 2012, why did steel industry really go through a difficult period in 2016 ?;

(2) by March 2016, the Ministry of Industry and Trade has just issued a decision on self-imposed tax on Vietnamese steel; while previous businesses were under great competitive pressure from cheap Chinese products. In 2017, galvanized iron and color corrugated iron products are also subject to self-imposed and anti-dumping taxes; This is considered the disassembly button, officially promoting the growth of Vietnam’s steel group.

In addition, the world steel price has recovered strongly since 2016 after creating a bottom, which is also a catalyst to help the steel industry increase sharply. Along with the move to cut production from China’s polluting plants, the balance of supply and demand has been more balanced and pushed steel prices up sharply since mid-2016 until mid-2016.

Steel price volatility

World steel prices fell 22% in just the past 03 weeks

Until the second half of 2018, steel prices after the period of acceleration are showing signs of shortness and likely to continue under pressure in 2019, analysts forecast. And in this context, the aforementioned forces are giving off less optimistic signals in the second half of 2018 and may extend into 2019., Phu Hung Securities said in a recent report.

2019 – the year of the division

According to PHS, 2019 will be the period when the steel industry has a clear division between steel segments as well as businesses, whereby opportunities and challenges may appear separately instead of for the whole industry such as previous period.

For flat steel (galvanized iron) industry less positive forecasts for businesses in this field (HSG, NKG, Ton Dong A, Ton Phuong Nam) due to two main reasons: (i) sharp increase in raw material prices directly affects business results ; (ii) capacity expansion activities using high leverage pose a risk to operation in the context of flat steel industry is under pressure of input.

For the long steel industry (steel pipe, construction steel), although unlikely to decline, it will be positive like the beginning of the year when the construction industry slowed down due to the impact from the real estate industry.

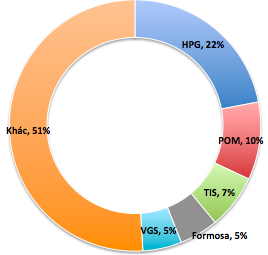

Construction steel market share.

In addition, the fact that other countries constantly open investigations and impose taxes on Vietnamese steel products makes the export outlook less positive, although this is a quite potential direction for steel manufacturing enterprises. of Vietnam. By the end of June 2018, the total number of anti-dumping lawsuits involving steel groups accounted for more than half of the total number of ant cases, and it is expected that investigations will continue to last and appear. This has a very negative impact on Vietnamese businesses, especially galvanized steel group when this is the main target that the investigations target.

Along with that, a sharp drop in world steel prices could make the steel industry face a difficult year due to increasing domestic competition pressure as well as reducing prospects for the export segment.

Falling demand for steel dragged prices down on concerns about global growth

Regarding the world steel price after peaking in June 2018, the adjustment and sharp decrease from 4,780 yuan / ton to 3,720 yuan / ton, equivalent to a 22% decline in the past 3 months. Due to the impact from the US-China trade war, many investors are quite concerned about the possibility of the world economy slowing down, thereby affecting the demand for goods. As a result, risky assets are subject to a significant reduction and steel is not out of the trend.

This intangibles generally put quite a pressure on the domestic steel industry when domestic products are forced to lower prices in order to compete with Chinese steel. Therefore, since the last quarter of 2018, steel enterprises have lowered their prices in order to compete with Chinese goods, in addition to excluding the possibility that steel prices may continue to continue in 2019.

Facing these difficulties, steel enterprises in the first 9 months of the year recorded a not so optimistic business situation over the same period, many units’ stocks also plummeted – even eliminating all growth efforts over the past time.

11 listed steel companies recorded total revenue of 135,552 billion dong, profit dropped 6% to 8,277 billion dong.

11 listed steel companies recorded a total revenue of 135,552 billion, profit decreased by 6% to 8,277 billion dong.

Tuc Mach

According to Tri thuc tre