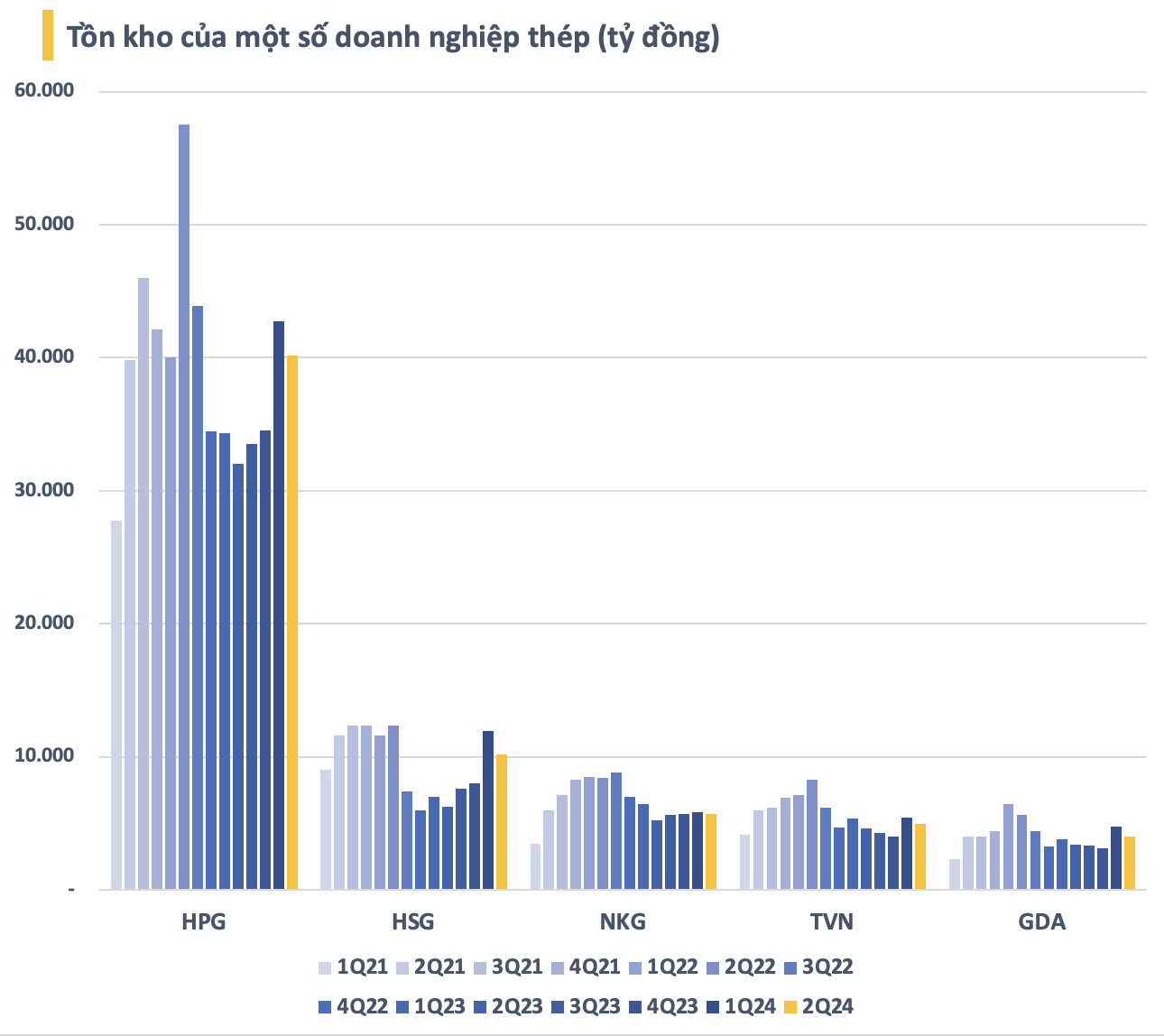

Most steel companies listed on the stock exchange have reduced their inventory size after the second quarter. In particular, the inventory value of Hoa Phat and Hoa Sen both decreased by over a trillion compared to the end of the first quarter. However, the current inventory level of these companies is still significantly higher than the general level in 2023.

In terms of structure, 5 enterprises, namely Hoa Phat, Hoa Sen, Nam Kim, VNSteel, and Ton Dong A, account for nearly 90% of the total inventory value of the entire steel industry on the stock exchange. Of which, Hoa Phat alone accounts for more than 53% with an inventory value at the end of the second quarter of more than VND 40,000 billion (including provisions for price reduction).

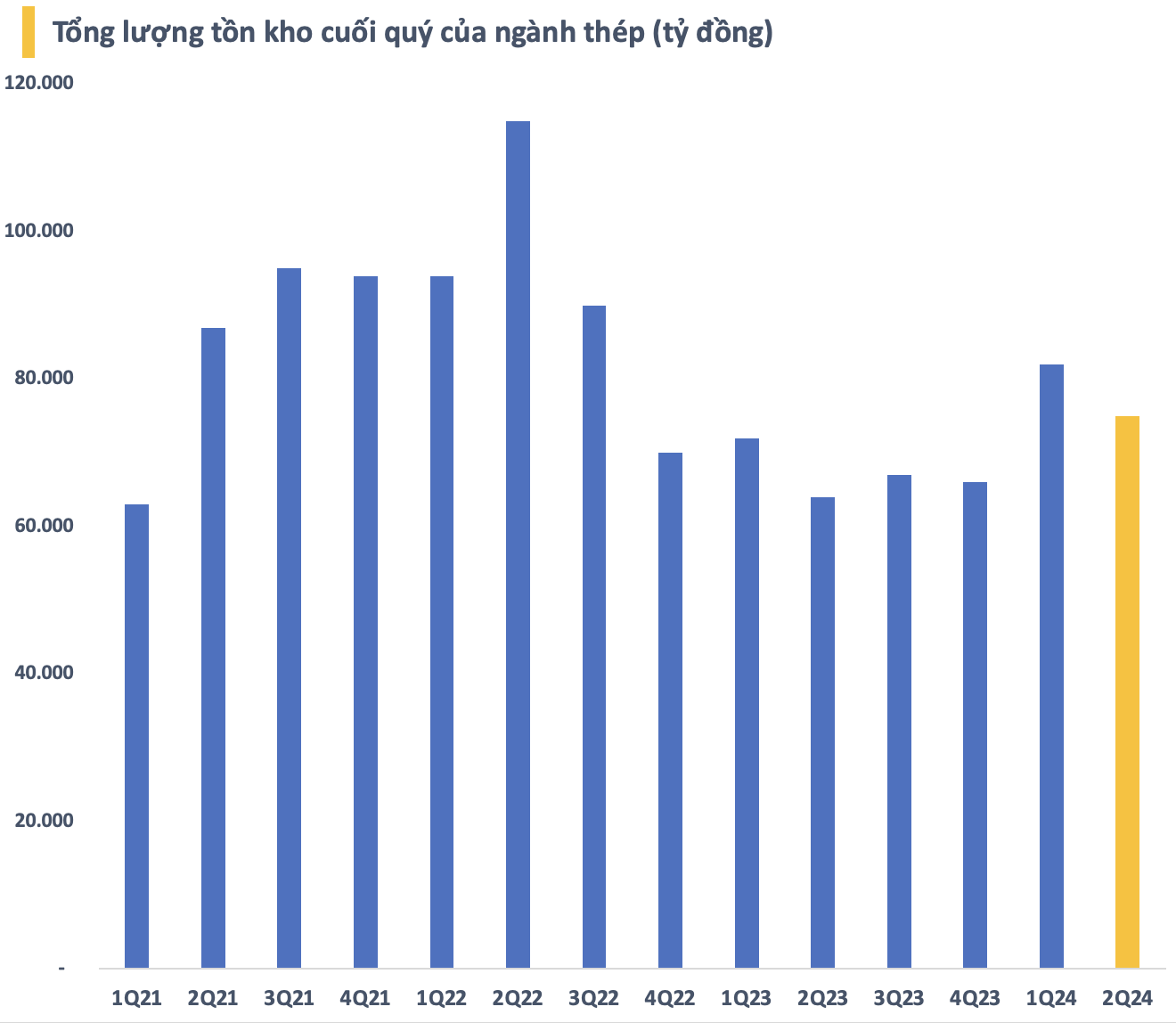

Steel industry inventories have fallen amid unfavorable global steel price trends. After a slight recovery in the second quarter, rebar futures prices have plummeted and fallen below CNY 3,000/ton for the first time since 2016, due to increasingly weak demand and abundant supply in the top consumer country, China.

The Chinese government issued new quality standards for steel rebar last September, prompting mills and traders to flood the market with old stocks. Meanwhile, China’s economy grew less than expected in the second quarter and the sluggish property market weakened steel demand.

In a recent report, Vietcap said that steel exports from China will continue to increase in 2024, after increasing 25% year-on-year in the first 5 months of 2024. As export volume in 2023 is equivalent to the period of 2014-16 when cheap Chinese steel exports flooded the global market, concerns about Chinese steel dumping are re-emerging.

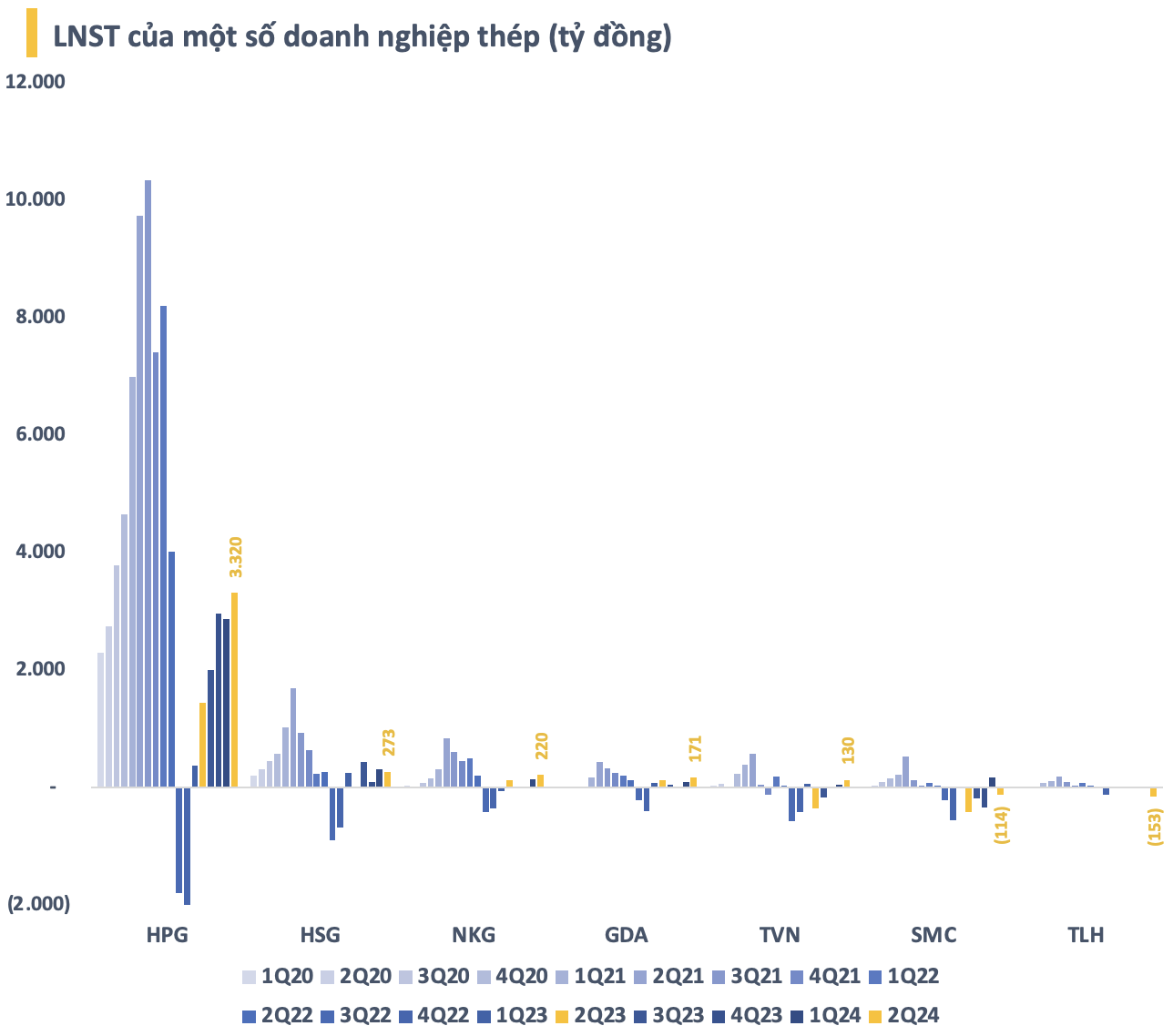

With the unfavorable trend of steel prices, although the inventory has decreased compared to the peak at the end of the first quarter, it is still quite high and will create considerable pressure on steel enterprises in the coming time. Previously, in the second quarter, steel enterprises had somewhat benefited from the recovery of steel prices (although not much) along with large inventories.

Most steel companies recorded a strong recovery in profits in the second quarter. The after-tax profits of Hoa Phat, Nam Kim, VNSteel, and Ton Dong A were all at their highest level in 2 years, starting from the second quarter of 2022. The total profit of the steel industry (excluding Pomina due to its unpublished financial statements) in the second quarter was about VND3,900 billion, most of which came from Hoa Phat.

“Holding our breath” waiting for anti-dumping decisions

Vietnam has been the top destination for China’s recent surge in steel exports, with output up 84% year-on-year in the first five months of 2024. This has prompted two domestic Vietnamese HRC steel producers (Hoa Phat and Formosa) and five galvanized steel producers (including Hoa Sen and Nam Kim) to submit anti-dumping (AD) investigation proposals to the Ministry of Industry and Trade.

The focus of the investigations is on HRC imported from China and India and galvanized steel imported from China and South Korea. However, Vietcap believes that the possibility of applying anti-dumping duties on HRC is quite low because domestic supply is not enough to meet HRC demand. Vietnam’s annual HRC demand is 12-14 million tons, far exceeding domestic supply (4-5 million tons) and the maximum domestic capacity is 8-9 million tons.

According to Vietcap, the threat to galvanized steel producers is significant and the possibility of applying anti-dumping duties to these products is higher. If sufficient evidence of dumping is found, Vietcap expects provisional anti-dumping measures to be applied as early as mid-September 2024. Hoa Phat will be the biggest beneficiary if anti-dumping duties are applied to both HRC and galvanized steel. Galvanized steel producers, including Hoa Sen and Nam Kim, will only benefit from anti-dumping duties on galvanized steel.

In another development, on July 30, 2024, the Trade Remedies Authority (Ministry of Industry and Trade) received information that the European Commission (EC) had received a complete and valid dossier requesting an investigation into the application of anti-dumping measures on non-alloy or alloy hot-rolled steel coil products imported from Vietnam. The list of manufacturers being complained about includes Hoa Phat and Formosa. These are also the only two enterprises that can produce hot-rolled steel coil in Vietnam.

In general, the CBPG decisions, if approved, will have a certain impact on steel prices as well as the production and business activities of enterprises in the industry. At this point, it is difficult to predict the final decision and enterprises will have to develop scenarios to respond to all possible cases.

Monetary security